audit vs tax vs advisory

From what I have been told Advisory pays more tends to be more interesting has better exit opportunities. Auditors work with clients from day one where as tax staff might not see clients for the first one of two tax.

Usa New York City Manhattan Time Square At Broadway Skyscraper Office Tower Ernst Young Ey E Y Multinational Company Provides Assurance Financial Audit Tax Consulting And Advisory Services Stock Photo Alamy

Search for jobs related to Audit vs tax vs advisory or hire on the worlds largest freelancing marketplace with 20m jobs.

. For example an auditor might work directly with 10-15 clients a year while a tax professional might deal with 100. I cant really be bothered to. Tax and audit roles offer little creativity mostly they just do boring regulatory work and paperwork.

Deadlines while the lull provided after a deadline is. Audit is only long during busy season Tax is usually clock work 9-5 and Advisory will depends on the deal during peak time youll be pulling long hours banker hours. Big 4 Audit Vs.

Tax- figuring out ways for corporates to get out of their obligations multiplying profit by the tax rate. Audit - Financial statements are reviewed and then certified to present a true and fair view of the entity. This is the very biased opinions Ive heard from friends in Advisory.

I personally find advisory work much more interesting. In the context of Big4s Assurance. Tax and audit groups work very long hours and get paid less than advisory.

I have been given the opportunity to chose Tax or Advisory at Public Accounting firm. If you really wish to open up your own firm tax could be for you. Advisory is supposedly seen as more prestigious than audit because its more quantitative and analytical.

Tax accountants typically work individually. Deciding whether to specialize in tax or audit is a choice that college accounting majors need to make. You are not tied down to only working in tax or only working in audit your entire career.

Business Tax Compliance or Business Tax Advisory for Clients Withholding Tax. Audit vs Tax Vs Advisory - - - - - - - - - - - -Audit- - - - - - - - - - - - Advantages. Lets dive into the pros and the cons of deciding between tax vs.

Many small firms are focused on bookkeeping and. Exposure to a wider range of industry financial reporting. What is the difference between audit and tax in accounting.

Primarily includes the Financial Statement Audits. Where as auditors work in teams. Have some free slabs of time available.

The Big 4 are consistently ranked. Audit - Asking for loads of paperwork and data and messing around in excel for a month. Diversified industry experience to sell.

Its called a learning experience you learn from it and you move on to something better. Some advisory positions are much worse than audit and some are much better. Either way dont let WSO get you down on audit too much.

Its free to sign up and bid on jobs. They tend to pay a bit better for tax since its more specialized. Multiple clients in less time.

Answer 1 of 5. Have an opportunity to learn more in less time.

Pwc Restructures For Future Of Bots Post Covid Advisory Boom

Crow Shields Bailey Pc Accounting Students Should You Choose Tax Or Audit

Big Four Revenue By Function 2021 Statista

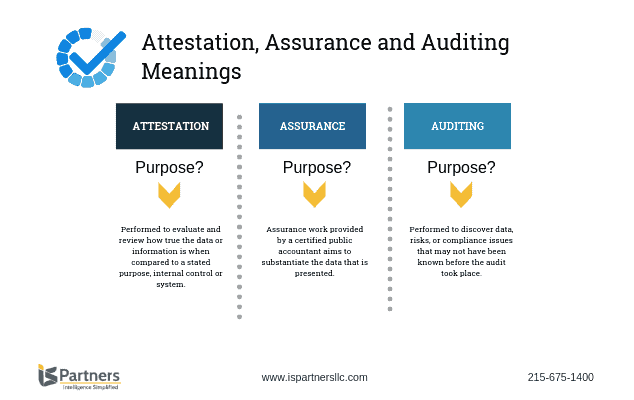

Audit Vs Assurance Top 5 Best Differences With Infographics

Why The Rise Of Partners In Big Four Accounting Firms Is Not As Dazzling As You Might Think The Economic Times

Edc Audit Accounting Advisory And Tax Services

Firm News Conner Associates Pc

Why We Don T Do Taxes Audits Or Strategic Advisory Services

Doing Hlb Ag Llc Audit Tax Business Advisory Services Facebook

Defining Attestation Auditing Assurance I S Partners Llc

Audit Tax Consulting Cpa Firm Briggs Veselka Co

How Mazars Virtually Trains Clients With Userguiding S Personalized Guides

Whitley Penn Audit Assurance Tax And Consulting Services

Choosing Between Tax Audit Consulting Youtube

Crow Shields Bailey Pc Accounting Students Should You Choose Tax Or Audit

Internal Audit And Financial Advisory Experienced Consultant Salary Comparably

Present To Win For A Leading Organization Of Independent Audit And Tax Advisory Lsa Global

Audit Tax Consulting Financial Advisory Services Grant Research And Grant Proposal Writing