cryptocurrency tax calculator australia

For it brilliant data analyzing. The brothers founded the.

Calculate Crypto Profit Gains Calculator 2022 Haru

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

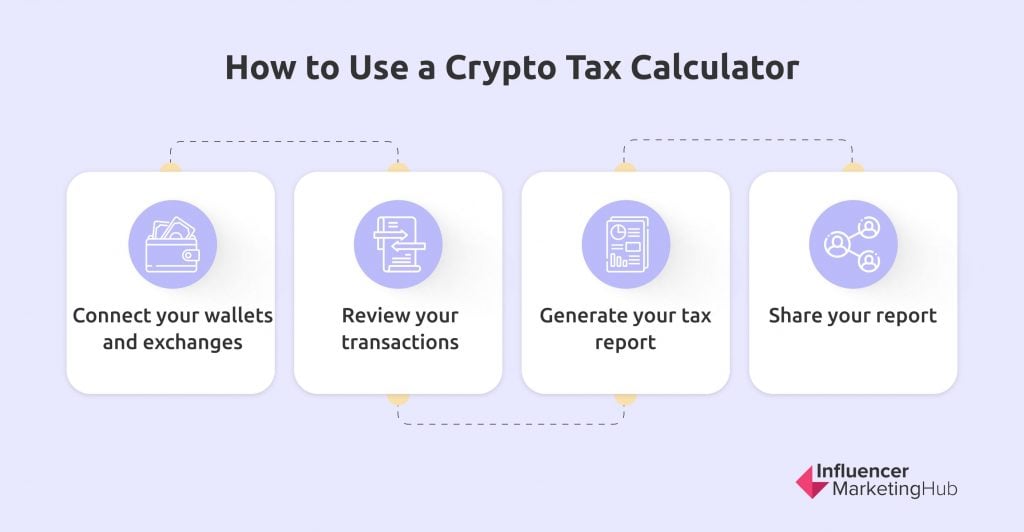

. You simply import all your transaction history and export your report. Income - Tradings GainsLosses Deductions. It takes less than a minute to sign up.

Australia - Income and Capital Gains Tax Rates. June 27 2022. Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes.

For cryptocurrency traders the formula differs a bit. For more information on the first steps to getting your. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you.

Built to comply with Aussie tax standards. Were still picking up a lot of customers who were trading in 20172018. If your cryptocurrency trades are conducted through a company registered with.

Crypto Tax Calculator for Australia. Please note that Rule 4 does not. Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale.

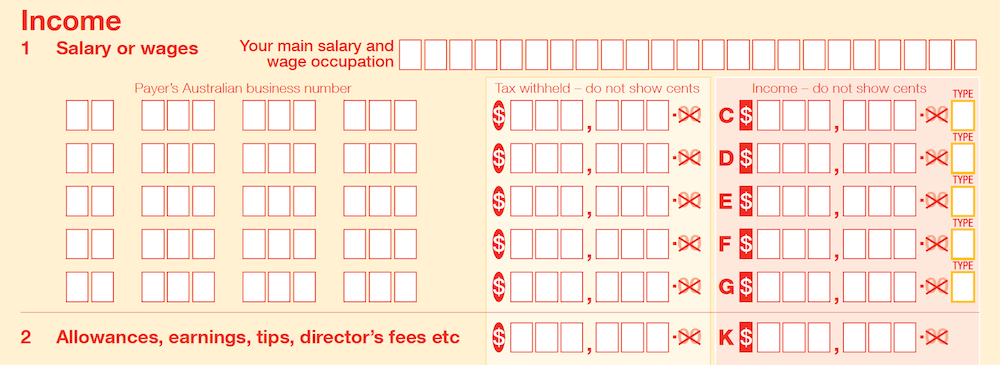

TokenTax is a crypto tax management company that was founded by Alex Miles back in 2017. Crypto income is declared on question 2 of Tax return for individuals 2022 NAT 2541. This platform directly imports data from crypto wallet merchants.

Crypto Tax Calculator Australia. 5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. This is why cryptocurrency tax Shane explains is kind of a lagging market.

It looks like this post is about taxes. 19 tax on income between AU18201 to AU45000 which come to AU5092. Crypto Tax Calculator Australia prides itself on making it simple to use our service when it comes to calculating your cryptocurrency tax.

If youve bought sold andor earned interest on cryptocurrency including non-fungible tokens NFTs during the financial year 1 July - 30 June youll need to declare your. The ATO has been vocal about their intention to crack down on Australian cryptocurrency users who are trying to avoid paying taxes so nows. Create your free account now.

This means you can get your books. Sold price This is the total value in AUD. Quick simple and reliable.

Youll need 2 forms one for income and one for capital gains. Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about.

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

3 Top Cryptocurrency Tax Calculators For 2020

![]()

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Cryptocurrency Bitcoin Taxes Complete Tax Guide 2022

Taxing Crypto Australian Tax Calculator Tools Time Business News

These Tools Will Help You Calculate Your Crypto Taxes Taxes Bitcoin News

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

How Much Tax Do You Pay On Crypto Gains Knowing Is A Must For Australian Tax Season Grit Daily News

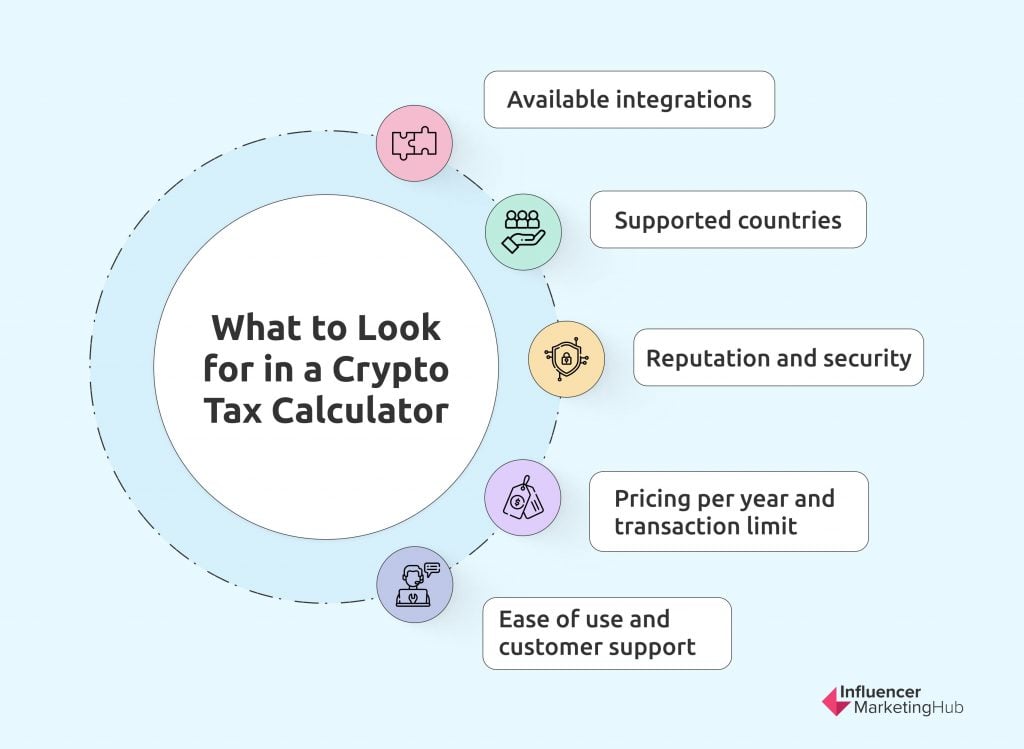

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

Koinly Bitcoin Tax Calculator For Canada

Crypto Tax Calculator Australia Cryptoaustralia Twitter

How To Work Out Cryptocurrency Tax Tutorialchip

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda